If you are new in project management or building a business service in your company, then this blog will help you understand in what exactly your CEO or CFO is looking to hear from you. Most of CEO or CFO dont really care about how good traffic the website is deliverying or how many leads you have get in a month or what kind of eBooks you are making. I believe most of them what are looking to hear is how much it will cost and what will be the revenue schedule.

Sad to hear this but is not about how good you talk, is more about the value you will bring with your ideas to the company in order to invest in you. Facts stand better than just only talk.

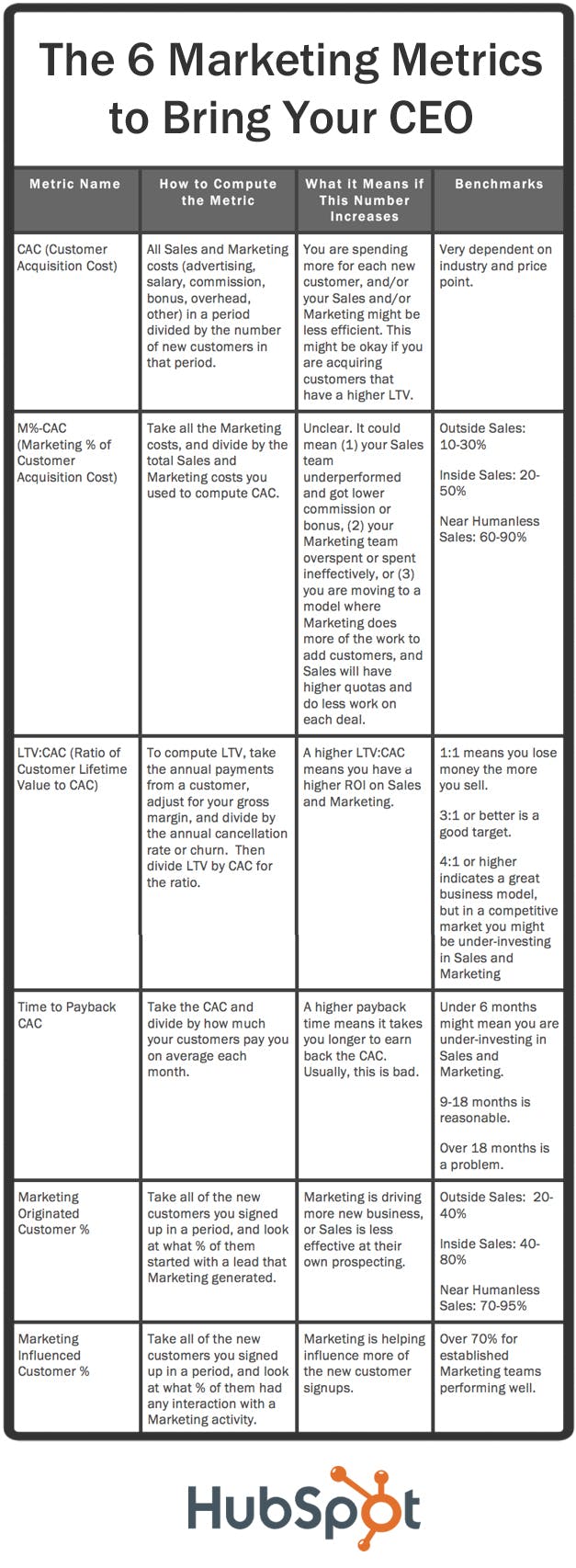

1. Customer Acquisition Cost (CAC)

This is your total Sales and Marketing cost — add up all the program or advertising spend, plus salaries, plus commissions and bonuses, plus overhead — in a time period, divided by the number of new customers in that time period. That time period, by the way, could be a month, a quarter, or a year. For instance, if you spent $300,000 on Sales and Marketing in a month and added 30 customers that month, then your CAC is $10,000.

2. Marketing % of Customer Acquisition Cost (M%-CAC)

I like to compute the marketing portion of CAC and call it M-CAC, and then compute that as a % of overall CAC. The M%-CAC is interesting to watch over time, and any change signals that something has changed in either your strategy, or your effectiveness.

For instance, an increase either means that 1) you are spending too much on marketing,2) that sales costs are lower because they missed quota, or 3) that you are trying to raise sales productivity by spending more on marketing and providing more and higher quality leads to Sales.

For a company that does mostly outside sales with a long and complicated sales cycle, M%-CAC might be only 10-20% . For companies that have an inside sales team and a less complicated sales process, M%-CAC might be more like 20-50% . And for companies that have a low cost and simpler sales cycle where sales are somewhat humanless, the M%-CAC might be more like 60-90% .

3. Ratio of Customer Lifetime Value to CAC (LTV:CAC)

For companies that have a recurring revenue stream from their customers — or even any way for customers to make a repeat purchase — you need to estimate the current value of a customer and compare that to what you spent to acquire that new customer.

To compute the LTV, you need to take the revenue the customer pays you in a period, subtract out the gross margin, and then divide by the estimated churn % (cancellation rate) for that customer. So, for a type of customer who pays you $100,000 per year where your gross margin on the revenue is 70%, and that customer type is predicted to cancel at 16% per year, then the LTV is $437,500.

Now, once you have the LTV and the CAC, you compute the ratio of the two. If it cost you $100,000 to acquire this customer with an LTV of $437,500, then your LTV:CAC is 4.4 to 1. For growing SaaS companies, most investors and board members want this ratio to be greater than 3X; a higher ratio means your Sales and Marketing have a higher ROI.Higher is not always better though ; when the ratio is too high, you might want to spend more on Sales and Marketing to grow faster, because you are restraining your growth by under-spending, and making life easy for your competition.

4. Time to Payback CAC

This is the number of months it takes you to earn back the CAC you spent to get a new customer. You take the CAC and divide by margin-adjusted revenue per month for the average new customer you just signed up, and the resulting number is the number of months to payback. In industries where customers pay one time upfront, this metric is less relevant because the upfront payment should be greater than the CAC, otherwise you are losing money on every customer. On the other hand, in industries where customers pay a monthly or annual fee, you usually want the Payback Time to be under 12 months, meaning that you become “profitable” on a new customer in under a year, and then after that you start making money.

5. Marketing Originated Customer %

This ratio shows what % of your new business is driven by Marketing. To compute it, take all of the new customers you signed up in a period, and look at what % of them started with a lead that Marketing generated. This is much, much easier to do when you have a closed-loop marketing analytics system , but you can do it manually — just know it will be time consuming.

What I like about this metric is that it directly shows what portion of the overall customer acquisition originated in Marketing, and it is often higher than Sales would lead you to believe. In my experience, this % varies widely from company to company. For companies with an outside sales team supported by an inside sales team with cold callers, this percentage might be pretty small, perhaps 20-40% ; for a company with an inside sales team that is supported by a lot of lead generation from Marketing, it might be 40-80% ; and for a company with somewhat humanless sales, it might be 70-95% .

Note: You can also compute this percentage using revenue, not customers, depending on how you prefer to look at your business.

6. Marketing Influenced Customer %

This is really similar to the Marketing Originated Customer %, but it adds in all the new customers where Marketing touched and nurtured the lead at any point during the sales process, not only by originating the lead. For instance, if a salesperson found a lead but then the lead attended a marketing event and then later closed, that new customer was influenced by Marketing. This % is obviously higher than the “Originated” percentage, and for most companies I think this should be between 50% and 99% .

Source : HubSpot – Mike Volpe